Dar Ul Andlus

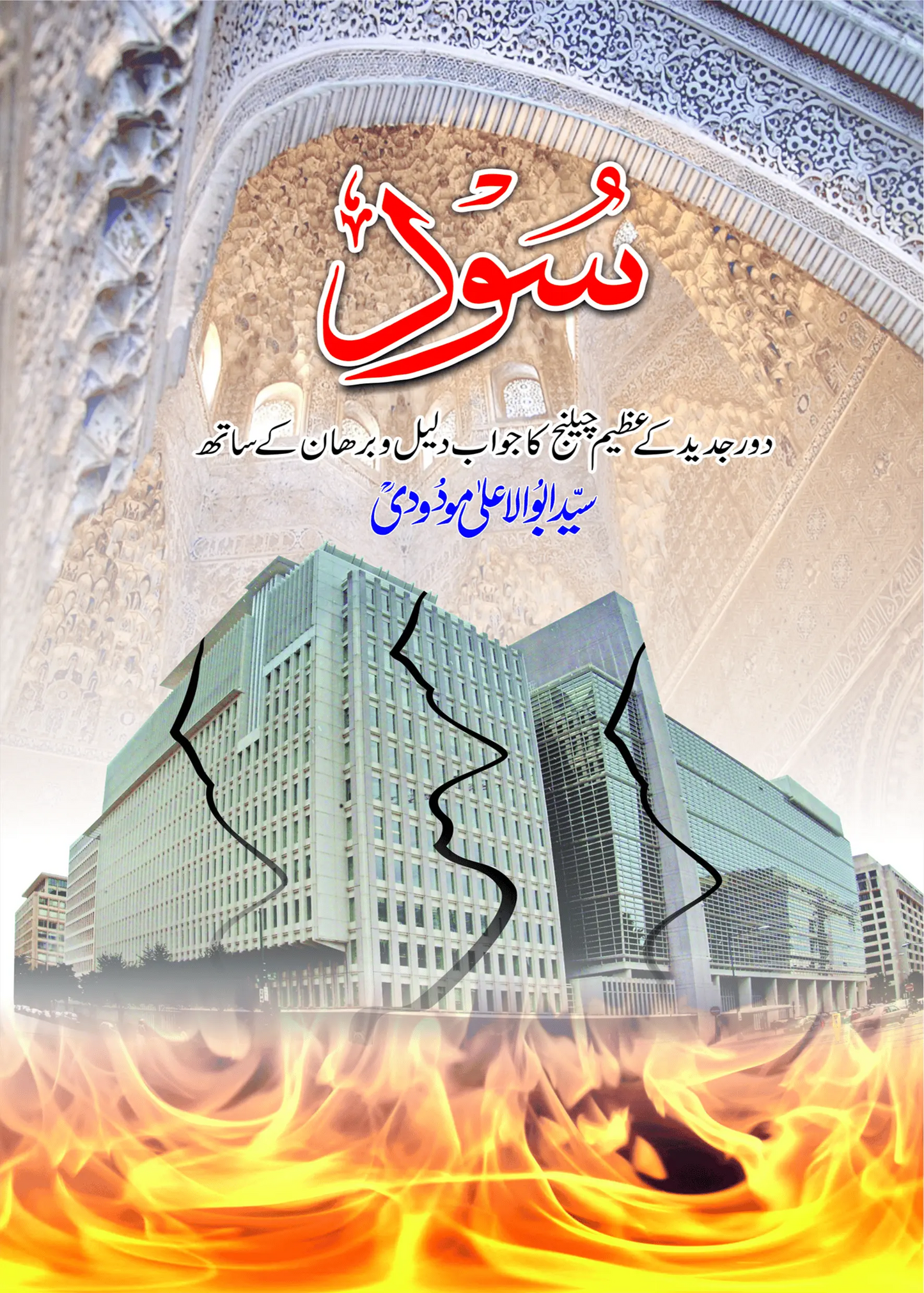

Sood (Interest)

Sood (Interest)

Couldn't load pickup availability

- Lowest Price

- Free Returns

- Global Delivery

Sood (Interest) – Definition and Harms

Sood (Interest) is one of the most widely debated financial practices in the world. In Islamic teachings, Interest is strictly prohibited because it leads to exploitation, injustice, and imbalance in society. The concept of Interest refers to charging an additional amount over the principal loan, which creates an unfair advantage for the lender while burdening the borrower. Understanding the harms of Sood is essential for building a fair economic system based on honesty and equity.

Why Interest is Prohibited

Islamic scholars emphasize that interest corrupts financial transactions, destroys compassion, and widens the gap between the rich and poor. Instead of promoting mutual benefit, it encourages greed and selfishness. The Qur’an and Hadith clearly warn against dealing with Interest, as it is seen as a means of oppression and a cause of instability in communities.

Effects of Sood on Society

When Sood dominates economic dealings, people become trapped in cycles of debt. Families and businesses may suffer financial collapse because of accumulating interest. This system not only weakens social bonds but also prevents true cooperation and brotherhood. On the other hand, Islamic finance encourages profit-sharing, fairness, and risk-sharing models, which bring blessings and stability.

In conclusion, avoiding Sood is not just a religious obligation but also a path to justice, balance, and long-term prosperity in society.

| Urdu Book Title | سود (سود) |

| ISBN | 81-8088-019-2 |

| Author | Syed Abul Ala Maududi |

| Language | Urdu |

| Book Pages | 304 |

| Book Size (cm) | 17x24 |

| Genre | General |

| Publication | Dar Ul Andlus |

| Colour | 1 Colour |

| Weight | 1.046 kg |

Share