Hadith Publications

Zaqa`at Kay Masail

Zaqa`at Kay Masail

Couldn't load pickup availability

- Lowest Price

- Free Returns

- Global Delivery

Zaqa`at Kay Masail

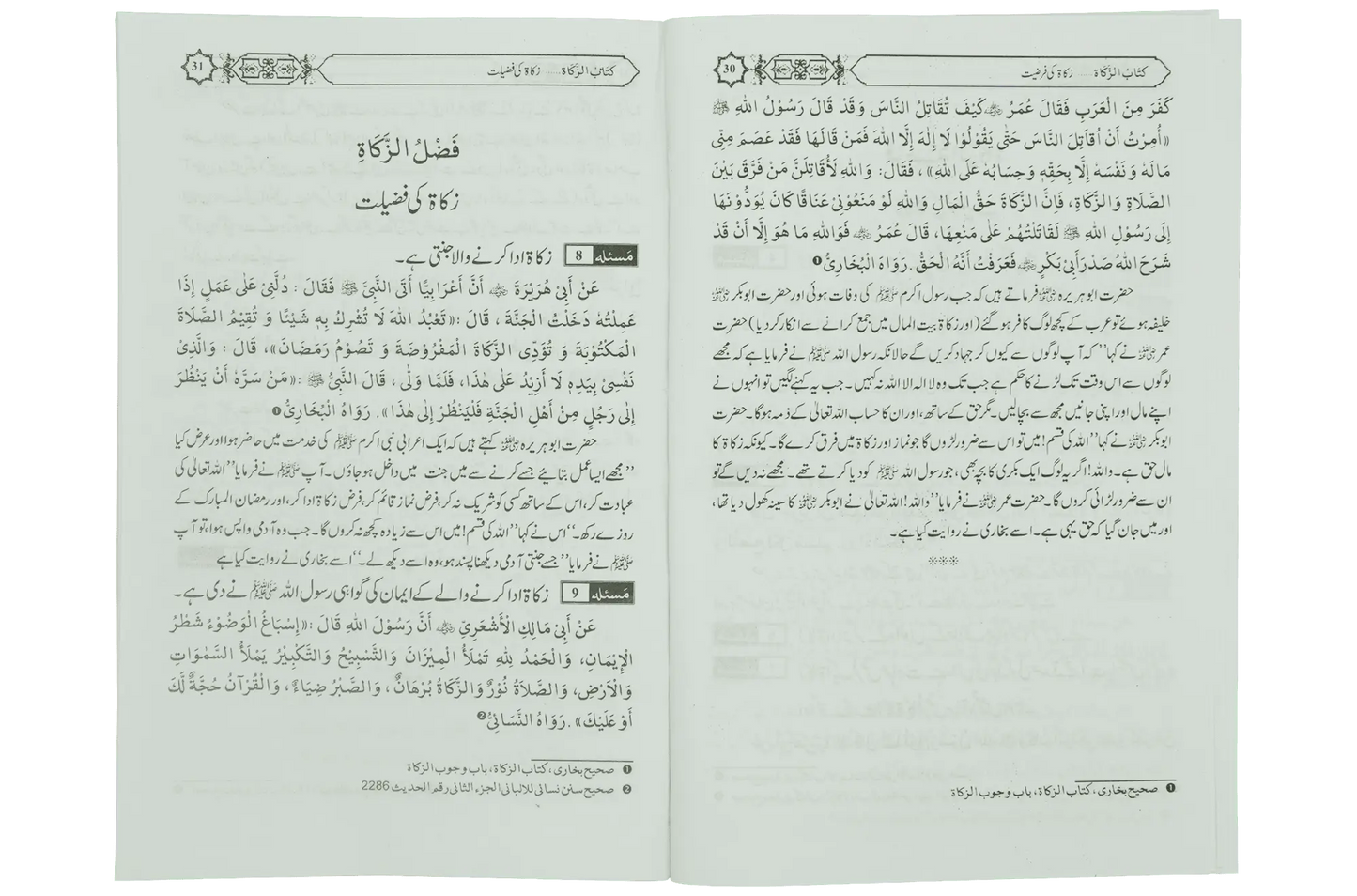

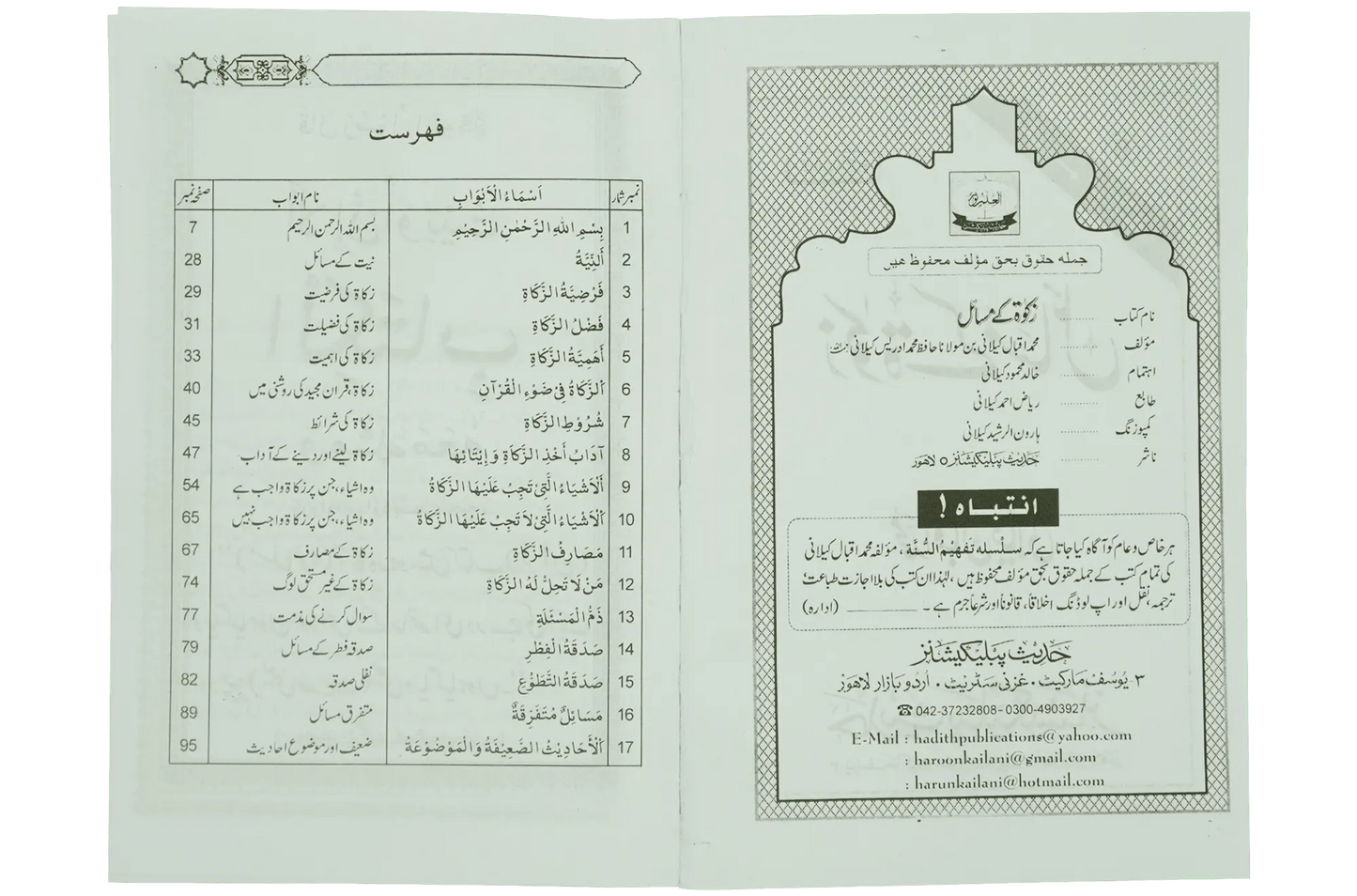

Zaqaat Kay Masail (issues of Zakat) are an essential part of Islamic jurisprudence, guiding Muslims on how to correctly calculate and distribute their zakat. Since zakat is one of the five pillars of Islam, every believer must understand these rulings to ensure their wealth is purified and shared with those in need. Zaqaat Kay Masail include matters such as who is obligated to pay zakat, what assets are zakatable, and how to calculate Nisab (the threshold amount).

Understanding Zaqa`at Kay Masail

The study of this book highlights several important conditions. First, a Muslim must possess wealth equal to or greater than the Nisab for one lunar year. This includes gold, silver, cash, business assets, and agricultural produce. Secondly, zakat must be distributed only among those eligible, such as the poor, needy, and travelers. This book clarify exemptions—personal items like houses, clothes, and vehicles are not zakatable.

Furthermore, the rulings ensure fairness and accuracy. For example, in business, inventory value is assessed, while in agriculture, the rate depends on whether natural irrigation or artificial watering is used. By studying this book, Muslims gain clarity on practical scenarios, ensuring that their zakat is both valid and beneficial for society.

| Urdu Book Title | زکوٰۃ کے مسائل |

| ISBN | D-3723280800081 |

| Author | Muhammad Iqbal Kilani |

| Language | Urdu |

| Book Pages | 96 |

| Book Size (cm) | 17x24 |

| Genre | General |

| Publication | Hadith Publications |

| Colour | 1 Colour |

| Weight | 0.14 kg |

Share